Can a Landlord Request Bank Statements in California: Unveiling the Truth

Yes, in California, a landlord can ask for bank statements from potential tenants. Renting a property in California can often require a thorough screening process for potential tenants.

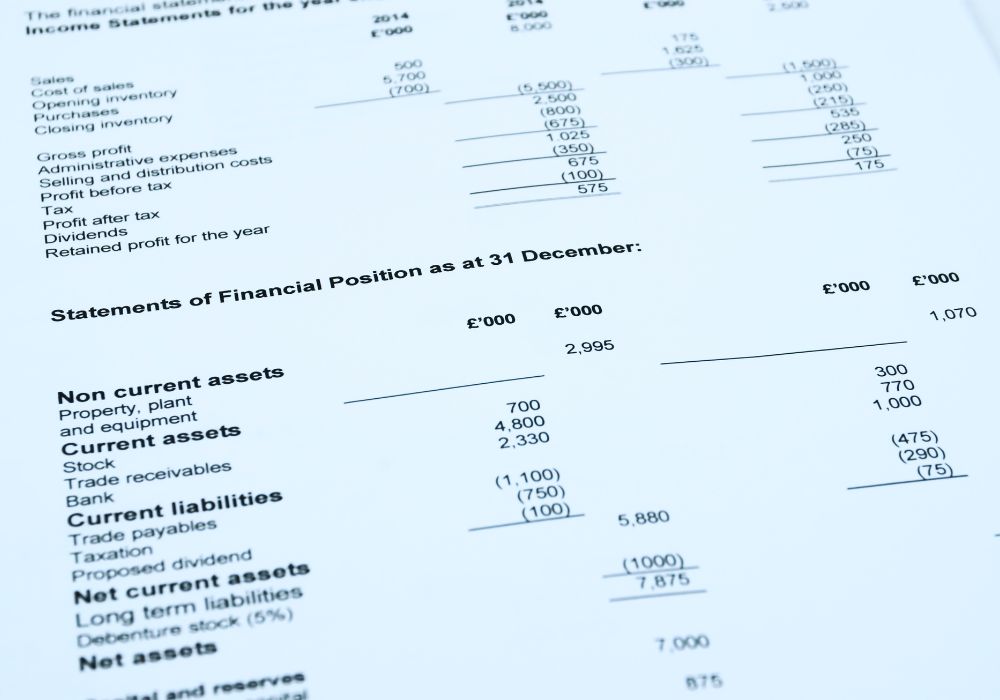

Landlords may request various documents to assess a tenant’s financial stability and ability to pay rent on time. One such document that a landlord can ask for in California is a bank statement. These statements provide a detailed overview of an individual’s financial transactions, including income deposits, expenses, and account balances.

By reviewing a tenant’s bank statements, a landlord can evaluate their financial capabilities and make a more informed decision when selecting a tenant. However, it is important for landlords to follow specific guidelines and regulations when requesting bank statements to ensure the privacy and legal rights of potential tenants. Understanding both the landlord’s rights and the tenant’s rights in this regard can help create a fair and transparent rental process.

Understanding The Legal Rights Of Landlords

When renting a property in California, it’s important for landlords to understand their rights. In this blog post, we will provide an overview of a landlord’s rights in California and discuss key factors that impact their ability to request bank statements from potential tenants.

Overview of a landlord’s rights in California:

| Landlord Rights | Explanation |

|---|---|

| Screening Process | Landlords have the right to screen potential tenants to ensure they meet certain criteria, such as having a reliable source of income and a good credit history. |

| Tenant Selection | Landlords can select tenants based on their qualifications and suitability for the property, taking into account factors like past rental history and employment verification. |

| Bank Statements | While there is no specific law in California that prohibits landlords from requesting bank statements, they must be mindful of fair housing laws and not discriminate against tenants based on protected characteristics. |

Factors that impact a landlord’s rights to request bank statements:

Landlords must consider factors such as the tenant’s consent, the purpose of requesting bank statements, and the legality of the request under fair housing laws. It’s crucial for landlords to handle personal financial information securely and abide by privacy regulations.

The importance of understanding the tenant screening and selection process:

Proper tenant screening and selection is crucial for landlords to ensure that they find reliable and qualified tenants. Conducting thorough background checks can help landlords avoid potential issues and maintain a positive rental experience for both parties involved.

Necessity And Validity Of Bank Statements For Tenant Screening

Bank statements can serve as valuable tools for landlords in California to assess the financial stability and creditworthiness of prospective tenants. These statements provide insights into an individual’s financial responsibility and can reveal patterns that help landlords make informed decisions when screening tenants.

| Benefits of Bank Statements for Tenant Screening | Investigating Tenant Creditworthiness | Patterns of Financial Responsibility |

|---|---|---|

| 1. Verification of Income: Bank statements can confirm the income stated by the tenant, ensuring they can afford the rental property. | 1. Debt-to-Income Ratio: Analyzing bank statements helps identify the tenant’s debt obligations and their ability to manage financial responsibilities. | 1. Consistent Savings: Regular deposits and a healthy balance show a tenant’s ability to meet financial obligations consistently. |

| 2. Detecting Financial Stability: Bank statements reveal the stability of a tenant’s finances and any potential red flags such as frequent overdrafts or insufficient funds. | 2. Payment History: By examining transaction records, landlords can assess if the tenant pays their bills on time and any recurring transactions indicative of financial stability. | 2. Responsible Spending Habits: Reviewing bank statements helps identify if the tenant manages their finances wisely and avoids excessive spending. |

| 3. Evaluating Financial Responsibility: Bank statement analysis provides an overview of the tenant’s financial practices, assisting landlords in evaluating their overall financial responsibility. | 3. Fraud Detection: Suspicious transactions or inconsistencies in bank statements can hint at potential fraudulent activity or unstable financial behavior. | 3. Debt Management: Landlords gain insights into how well tenants handle their debts, including loan payments, credit card utilization, and overall financial commitments. |

Privacy Concerns And Tenant’s Rights

In California, tenants have privacy rights when it comes to disclosing their personal financial information, such as bank statements, to their landlords. The state has legal limitations in place to protect tenant privacy. Landlords cannot simply ask for bank statements without a valid reason or legal basis. This is done to balance the tenant’s rights to privacy with the landlord’s need for information. However, there are certain situations where a landlord may have a legitimate reason to request bank statements, such as evaluating a tenant’s ability to pay rent or assessing creditworthiness. In these cases, landlords must follow the proper procedures and obtain the tenant’s consent, if required by law. It is important for both tenants and landlords to understand these privacy rights and limitations to ensure compliance with California law.

Alternatives To Bank Statements For Tenant Evaluation

If you are a landlord in California, you may wonder if there are alternatives to asking for bank statements when evaluating potential tenants. One option is to assess their credit scores and credit reports. This can provide valuable insight into their financial reliability and payment history. Another alternative is to request pay stubs or employment verification to validate their income. This can give you confidence that they have a stable source of income to cover their rent obligations. By diversifying your methods of evaluating tenants, you can gain a more comprehensive understanding of their financial situation. This will help you make an informed decision when selecting the most suitable tenants for your property.

Best Practices For Requesting Bank Statements

Requesting bank statements from tenants is a common practice for landlords in California, but it is essential to follow best practices to ensure compliance with fair housing laws and anti-discrimination regulations. To maintain transparency and avoid any potential issues, landlords should provide clear guidelines and consent forms to tenants regarding the bank statement request process.

Creating a secure and confidential method for tenants to submit their bank statements is crucial to protect their personal information. Landlords should prioritize the safety of tenant data by establishing secure online platforms or encrypted email services for document submission.

By adhering to best practices and incorporating these guidelines, landlords can effectively request bank statements while respecting tenants’ privacy rights and complying with legal requirements.

Legal Actions Against Landlords For Unauthorized Access

When a landlord asks for a tenant’s bank statements in California, it is important to understand the legal actions that can be taken against them for unauthorized access. Landlords who unlawfully access bank statements can face penalties and legal actions. Under California law, tenants have the right to privacy and landlords must respect their privacy rights.

The consequences of breaching tenant privacy rights can be severe. Landlords may be held liable for damages caused by unauthorized access to bank statements. Tenants have recourse for violations of privacy laws, such as filing a complaint with the California Department of Fair Employment and Housing (DFEH) or seeking legal representation to pursue a lawsuit against the landlord.

It is crucial for landlords to understand and respect tenant privacy rights when it comes to requesting sensitive financial information such as bank statements. Failure to do so can result in legal consequences and harm the landlord’s reputation.

Frequently Asked Questions For Can A Landlord Ask For Bank Statements California

Is It Normal For A Potential Landlord To Ask For Bank Statements?

Yes, it is normal for a potential landlord to ask for bank statements as part of the rental application process. Bank statements provide proof of financial stability and ability to pay rent.

What Documents Can A Landlord Ask For In California?

A landlord in California can ask for documents such as identification, proof of income, credit history, rental references, and employment verification from potential tenants.

What Can I Black Out On My Bank Statement For An Apartment?

You can black out personal information like account numbers and transaction details on your bank statement before submitting it for an apartment application.

What Questions Can Landlords Not Ask In California?

In California, landlords cannot ask about your immigration status, sexual orientation, or any disability you may have. They also cannot ask about your marital status or how many children you have.

Conclusion

While landlords in California have the right to ask for bank statements, there are certain limitations that should be considered. It is essential for both landlords and tenants to understand the legal aspects and privacy rights involved in this process.

To ensure a fair and transparent rental application process, landlords should exercise caution and make sure they abide by the law when requesting bank statements from potential tenants.

[…] using a subtle bank statement descriptor, OnlyFans aims to provide a secure and private experience for its […]