Cash Surrender Value Life Insurance: Maximize Your Benefits

Cash surrender value is the amount an insurance policyholder receives upon canceling their life insurance policy. It represents the savings component accumulated in permanent life insurance policies.

Understanding cash surrender value in life insurance is crucial for policyholders considering the cancellation of their policies. This value is particularly pertinent in policies that blend a savings element with insurance coverage, such as whole life or universal life insurance.

Upon surrendering a policy, the holder is entitled to receive the savings portion of their premiums, which can be a source of liquid cash if needed. However, policyholders should be mindful of potential surrender charges and tax implications triggered by cashing out a policy. Knowing the exact cash surrender value helps individuals make informed financial decisions about maintaining or terminating their life insurance.

What Is Cash Surrender Value

The cash surrender value of life insurance refers to the amount of cash an individual can receive upon canceling their permanent life insurance policy. It is different from the policy’s cash value, which is the savings component that grows over time. The surrender value is actually the cash value amount less any fees or penalties for early policy termination.

Understanding the cash surrender value is crucial for policyholders to make informed decisions about their life insurance investments. It’s important to note that in the initial years of a policy, the surrender value might be significantly lower than the cash value due to the insurer’s upfront costs and surrender charges.

| Cash Value | Surrender Value |

|---|---|

| Accumulated savings component of a life insurance policy. | Amount receivable after deducting fees and penalties from the cash value. |

| Grows over time and can be borrowed against. | Typically lower in the policy’s early years due to surrender charges. |

| Does not usually decrease unless loans are taken against it. | Can fluctuate based on policy terms and surrender charges. |

Maximizing Your Benefits

Maximizing the benefits of your life insurance policy entails understanding the cash surrender value. This is the amount you can receive if you decide to surrender the policy before it matures or the insured event occurs. One effective strategy is timely surrender, which means strategically choosing the moment you surrender your policy to ensure the highest possible payout.

Policyholders should consider surrendering their policies after significant cash value accumulation which is often after several years of maintaining the policy. By doing so, one will minimize the impact of surrender charges and maximize the overall return.

Understanding the timeline and fees associated with surrender is crucial to optimize the surrender value. Different policies have varied surrender schedules, and being cognizant of such details can lead to a more advantageous outcome. Consulting a financial advisor to discern the most opportune time frame that aligns with your financial goals can enhance the payout.

Accessing Your Cash Surrender Value

Accessing the Cash Surrender Value of a life insurance policy can be accomplished through either a policy loan or a direct withdrawal. Choosing between a loan and withdrawal depends on the policyholder’s financial situation and the terms set by the insurance provider.

Taking out a policy loan allows policyholders to borrow against the cash value of their insurance, typically at a lower interest rate than a personal loan. This option does not reduce the cash value but requires policyholders to pay back the loan with interest to maintain their policy benefits. On the other hand, a direct withdrawal permanently reduces the policy’s cash surrender value and may impact the death benefit.

The tax implications of accessing cash value are important to consider. Loans are generally not taxable as long as the policy remains in force, whereas withdrawals may be taxable beyond the cost basis. It’s essential to consult with a tax professional to understand the specific consequences for your individual circumstances.

Regular Review And Adjustments

Regular assessment of your life insurance policy ensures that it accurately reflects your current financial situation and goals. It is essential to conduct an Annual Policy Review as various factors such as income changes, investment returns, or adjustments in your personal life could significantly affect your policy’s performance and the associated Cash Surrender Value.

Life changes such as marriage, divorce, the birth of a child, or a new career path can all have profound impacts on your insurance needs. Assessing the policy annually aids in identifying any necessary modifications to ensure that the benefits align with your life’s trajectory. Failure to review and adjust your life insurance policy could lead to unexpected financial issues or a lapse in coverage at a time when support is most needed.

Investing Cash Value Wisely

Long-Term Investment Strategies should be approached with meticulous planning and consideration of one’s financial timeline. Investment options such as stock mutual funds, bonds, and real estate offer potential growth over time, tapping into the power of compounding interest. Diversifying investments is essential to mitigate risks while striving to achieve a balanced and robust portfolio. Engaging a financial advisor could provide insight tailored to individual needs and financial goals, optimizing the use of cash surrender value from life insurance policies for future wealth.

Different investment avenues carry varying degrees of risk and potential return, and understanding these is critical. Market volatility could significantly impact investment performance, making it imperative to understand the tolerance for risk and investment horizon. Taxes, fees, and penalties can also affect net returns. Therefore, policyholders should consider their unique circumstances and consult with tax and investment professionals before reallocating assets.

Whole Life Insurance Explained

Whole life insurance is a type of permanent life insurance that remains in effect for the insured’s lifetime, provided premiums are paid on schedule. This form of policy not only offers a death benefit but also incorporates a savings component, known as the cash surrender value. The cash value accumulates on a tax-deferred basis over time and can be used as collateral for loans or even withdrawn if needed.

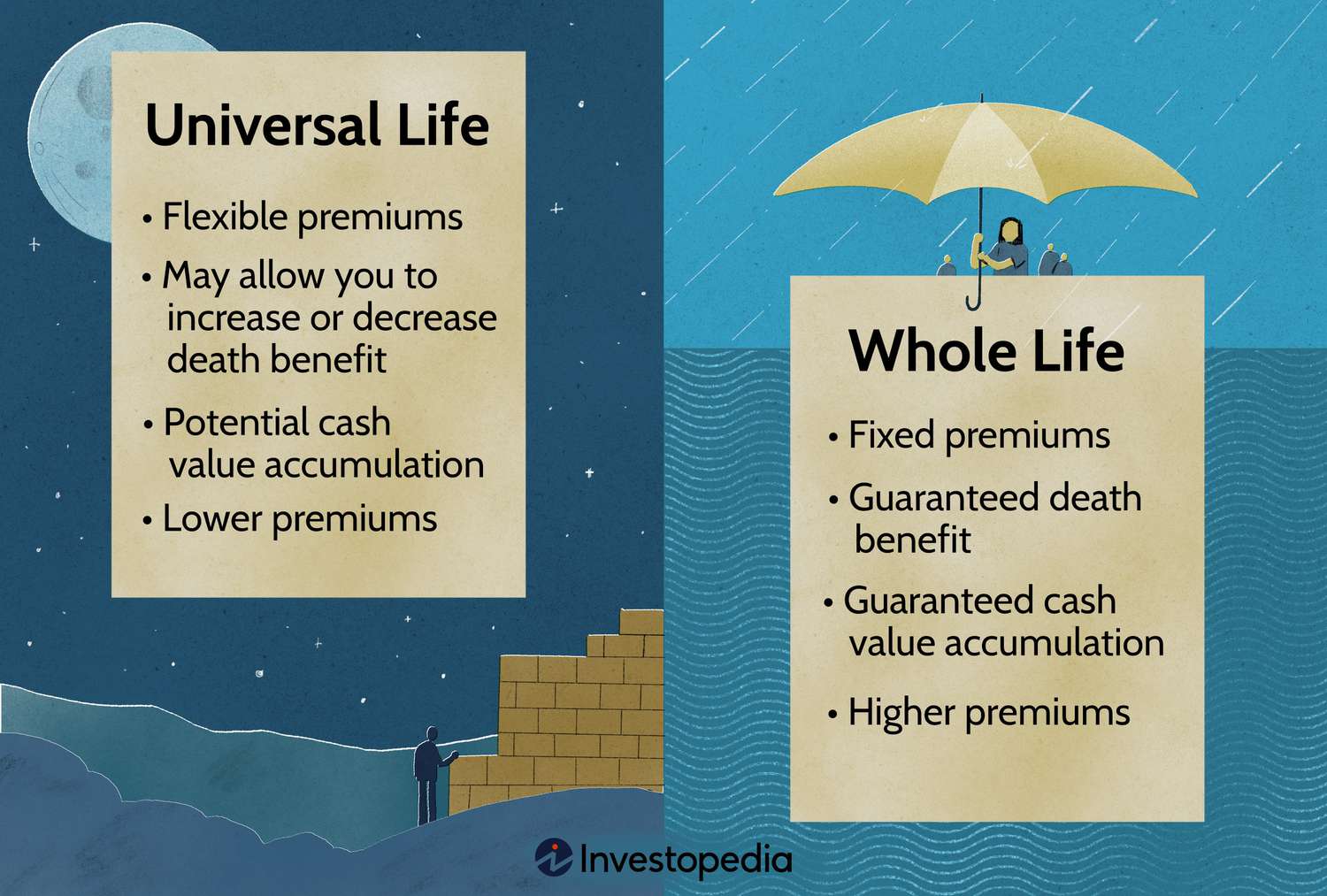

When evaluating life insurance options, it’s crucial to compare whole life insurance with other types such as term life and universal life policies. Unlike term life insurance, which is temporary and only provides a death benefit, whole life insurance ensures lifetime coverage and builds cash value. On the other hand, universal life offers more flexibility than whole life in terms of premium payments and death benefits but may not have the same level of guaranteed cash value accumulation.

Universal Life Insurance Overview

Universal life insurance stands out for its flexibility in premium payments and the potential for cash value accumulation. Policyholders have the freedom to adjust their premiums within certain limits, which means they can choose how much to pay into the policy (within policy limits) at any given time. This can be particularly advantageous for individuals with fluctuating income.

The cash value aspect of universal life insurance policies can act as a savings component, growing over time based on the interest credited, which is often tied to a financial index. As the cash value increases, policyholders may have the option to make withdrawals or take out loans against their policy, adding to the policy’s versatility.

Comparatively, whole life insurance comes with fixed premiums and a guaranteed cash value accumulation, offering a more predictable approach to policyholders. The simplicity of whole life insurance is a clear benefit for some, while others may prefer the flexibility that universal life offers. Each option has its own set of pros and cons, tailored to different financial needs and goals.

Avoiding Common Pitfalls

Cash surrender value life insurance policies are complex products that can offer substantial benefits if managed correctly. Understanding the potential pitfalls linked with the policy’s cash value performance is crucial. Suboptimal returns can drastically affect the policy’s value, leading to reduced benefits.

Prompt recognition of cash value underperformance is a must to prevent financial disappointment. Regularly reviewing policy statements and comparing them against expected growth projections enables policyholders to stay aware of their investment’s trajectory. Failure to address underperformance can lead to a need for higher premiums or diminished final payouts.

The consequences of policy lapses can be severe. Lapses occur when necessary premiums are not paid, potentially leading to a loss of coverage. The resulting scenario means that individuals may be left without insurance protection, and previously paid premiums could be forfeited. This situation underscores the importance of maintaining premium payments and remaining vigilant about policy terms.

Resolving Cash Value Growth Issues

Stagnant cash values in a life insurance policy can be concerning but addressing this involves a few strategic steps. Reviewing and possibly adjusting the premium payments can revitalize the policy’s cash value growth. Policyholders should also consider the performance of the underlying investments tied to the policy and may need to switch to more growth-oriented options if the current allocation isn’t yielding expected returns.

Effective management of policy loans is crucial to sustain growth of the cash surrender value. To prevent loan interest from eroding the cash value, borrowers should aim to pay loan interest promptly. One method is to use dividends from the policy to pay off the loan interest, thereby maintaining the policy’s integrity and ensuring continual cash value accumulation.

Using Cash Value For Retirement

The cash surrender value of a life insurance policy can be a crucial component in retirement planning. Individuals may consider leveraging their policy’s value as a steady stream of income during retirement, ensuring financial stability in their golden years. Policies designed as a Life Insurance Retirement Plan (LIRP) offer the dual benefit of a death benefit and a tax-advantaged savings element.

LIRP basics are centered around the idea of accumulating cash value over time, which policyholders can access via loans or withdrawals. These funds extracted from the policy are often tax-free, making them a compelling choice for those seeking additional retirement income sources. It’s crucial for policyholders to comprehend their policy details and consult with a financial advisor to optimize the use of their life insurance for retirement planning.

Legacy And Estate Planning

Cash surrender value life insurance offers dual benefits for policyholders who aim at legacy and estate planning. Not only does it provide a death benefit to beneficiaries, but it also accumulates a cash value over the lifetime of the policy. This cash value can enhance the eventual payout upon the policyholder’s demise, potentially providing a more significant financial legacy.

The accumulation of cash value within a life insurance policy also allows for efficient wealth transfer. Beneficiaries could receive a larger, tax-favored inheritance as a result of the policy’s growth. Utilizing the cash surrender value, policyholders might choose to borrow against the policy or even cash it out during their lifetime, affording them flexibility in managing their financial affairs.

Credit: www.bankrate.com

Frequently Asked Questions On Cash Surrender Value Life Insurance

What Is The Cash Value Of A $10000 Life Insurance Policy?

The cash value of a $10,000 life insurance policy varies based on age, policy type, and duration of payments. Generally, it accumulates over time and is less than the policy’s face value. Contact your insurance provider for the exact amount.

Can I Withdraw My Cash Value From Life Insurance?

Yes, you can withdraw cash value from a life insurance policy, depending on the terms of your policy and if enough cash value has accumulated. Withdrawals may reduce the death benefit and could have tax implications.

How Much Of Cash Surrender Value Is Taxable?

The cash surrender value is taxable when it exceeds the sum of your premiums paid.

Is Cash Surrender Value Fair Value?

Cash surrender value is not necessarily fair value. It represents the policy’s cash value less any surrender charges and may differ from the policy’s market value or actual worth.

Conclusion

Understanding the cash surrender value of your life insurance policy is critical for making informed financial decisions. It offers a safety net, should your circumstances change. Seek professional advice to maximize this feature’s benefits. Remember, staying informed ensures your policy serves your long-term financial strategy effectively.