Can Welfare Access Your Bank Accounts? Uncovering the Truth

No, welfare can find out about bank accounts if they have a valid reason and obtain a court order to access the information. Welfare programs are set up to assist individuals and families who are in need of financial help.

These programs typically require applicants to provide information about their income, assets, and expenses. While welfare agencies may not have immediate access to individuals’ bank account information, they can request this information if they suspect fraud or if they have a court order.

In some cases, recipients may be required to provide bank statements or other financial records as part of their application or ongoing eligibility determination. It is important for individuals to be truthful and provide accurate information to welfare agencies to avoid potential penalties or criminal charges.

The Basics Of Welfare And Financial Privacy

html

The basics of welfare programs and financial privacy are closely intertwined. Welfare programs serve as a safety net for individuals and families who may be facing financial hardships. These programs aim to provide assistance in the form of financial aid, healthcare, housing, and other essential resources.

Financial privacy, on the other hand, is the right to keep personal financial information confidential and secure. Individuals have the right to control who has access to their banking and financial data.

When it comes to welfare programs, there is a need to investigate an individual’s financial situation to determine eligibility and the level of support required. This may involve examining bank account details, income, and other relevant financial information to ensure that assistance is provided to those truly in need.

However, it is important to note that banking institutions have a responsibility to maintain client confidentiality and protect personal information. They cannot disclose any banking information to welfare agencies without the individual’s consent or a valid court order.

In conclusion, while welfare programs necessitate some level of investigation into individuals’ financial circumstances, financial privacy remains a crucial aspect of personal rights. Proper protocols and legal safeguards are in place to protect individuals’ confidential information from unauthorized access.

Privacy Laws And Protections For Bank Accounts

Banks play a crucial role in safeguarding personal financial information, ensuring privacy and protecting against unauthorized access. Privacy laws and regulations govern the collection, use, and disclosure of personal data by banks, including information related to bank accounts. These legal frameworks aim to strike a balance between individual privacy and the need for financial institutions to comply with anti-money laundering regulations and combat fraud.

Legislation such as the Gramm-Leach-Bliley Act (GLB), the Bank Secrecy Act (BSA), and the Financial Privacy Act (FCRA) establish guidelines for banks to follow when handling and sharing customer data. These laws require banks to maintain the confidentiality of customer information and implement security measures to protect against unauthorized access or disclosure.

However, it is important to note that there are limitations and exceptions to privacy protections. For instance, banks may disclose personal information when required by law, in response to a court order, or to prevent fraud or illegal activities. Additionally, banks may share customer information with affiliated companies or third-party service providers, but only if they have implemented appropriate safeguards to protect the data.

In summary, privacy laws and protections for bank accounts are in place to ensure the confidentiality and security of personal financial information. While these regulations aim to safeguard privacy, they also provide flexibility for banks to share information when necessary to comply with legal requirements or enhance fraud prevention measures.

Can Welfare Agencies Access Your Bank Accounts?

Can Welfare Agencies Access Your Bank Accounts?

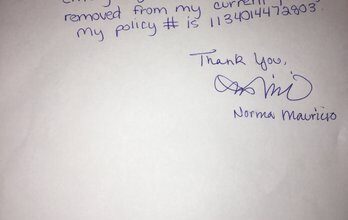

Debunking common misconceptions about welfare access to bank accounts

There is often confusion and uncertainty surrounding the extent to which welfare agencies can access individuals’ bank accounts. Understanding the circumstances under which welfare agencies may access bank account information is essential in dispelling misconceptions.

When it comes to accessing bank account information, welfare agencies are typically required to follow legal requirements and procedures. They cannot access bank accounts without proper authorization or a valid reason. In most cases, welfare agencies need to obtain a court order or written consent from the account holder before accessing bank account information.

Welfare agencies may be granted access to bank account information under specific circumstances. These may include investigating fraud, verifying eligibility for benefits, or enforcing child support payments. However, it is important to note that accessing bank account information is not a routine practice for welfare agencies and is reserved for specific situations.

To protect your bank account information, it is advisable to stay informed about your rights and be aware of the legal requirements that welfare agencies must adhere to. If you have any concerns about the access to your bank accounts, it is advisable to consult legal counsel to understand your rights and options.

Credit: us.macmillan.com

Potential Consequences Of Welfare Agency Access

Can Welfare Find Out About Bank Accounts

Potential Consequences of Welfare Agency Access

Assessing the impact of welfare agency access on individuals’ financial privacy:

- Risks and abuses: Welfare agency access to bank accounts raises concerns about privacy violations. There is a potential for misuse and unauthorized access to personal financial information, which can lead to identity theft or fraud.

- Supervision and accountability: Proper supervision and accountability mechanisms are crucial to prevent the misuse of information. Having stringent policies and protocols in place can ensure that only authorized personnel have access to bank account details, reducing the risk of privacy breaches.

It is important to strike a balance between providing support to those in need and safeguarding individuals’ financial privacy. Welfare agencies should establish robust safeguards to protect sensitive financial information and regularly review these measures to ensure compliance with privacy regulations. By prioritizing supervision and accountability, potential abuses can be minimized, fostering public trust in the welfare system.

Protecting Your Financial Privacy

When receiving welfare benefits, it is crucial to take steps to protect your financial privacy, especially sensitive information related to your bank accounts. Here are some practical measures you can follow to safeguard your personal bank account information:

- Regularly monitor your bank accounts for any unauthorized transactions or suspicious activity.

- Create strong and unique passwords for online banking and regularly update these passwords.

- Avoid sharing personal bank account details, such as account numbers or online banking credentials, with anyone you don’t trust implicitly.

- Consider using two-factor authentication for added security when accessing your bank accounts online.

- Opt for paperless banking to minimize the risk of sensitive information being intercepted through mail.

- Choose secure banking apps or platforms that use encryption to protect your data.

- If you prefer additional privacy, explore alternative banking options such as online-only banks or credit unions that offer enhanced security measures.

- Be cautious when disclosing personal information on social media platforms or other online channels, as it could potentially be used against you.

- In case of any suspicious activity, promptly report it to your bank and the appropriate authorities.

By following these tips, you can enhance your financial privacy and protect your personal bank account information while receiving welfare benefits. Stay vigilant and prioritize the security of your financial data.

Personal Stories And Case Studies

Personal stories and case studies play a crucial role in shedding light on the experiences of individuals affected by welfare agency access to bank accounts. These stories provide a human perspective on the topic, allowing us to understand the consequences and learn valuable lessons from these real-life situations.

Through these personal accounts, we can see the impact of welfare agency access and the potential violations of privacy it may entail. By highlighting these stories, we can raise awareness about the importance of protecting individuals’ rights and privacy when it comes to their bank accounts.

Sharing these experiences helps to create a dialogue and foster understanding among policymakers, welfare agencies, and the public. It enables us to critically evaluate the practices in place and find solutions that respect individuals’ privacy while still serving the objectives of welfare programs.

Frequently Asked Questions On Can Welfare Find Out About Bank Accounts

Can Welfare Agencies Access My Bank Accounts?

Welfare agencies can access your bank accounts with your permission or with a court order. However, they generally need a valid reason, such as fraud or suspicion of illegal activity, to do so. It’s important to remember that welfare agencies prioritize helping individuals and families, rather than invading their privacy.

Will Welfare Find Out If I Have A Secret Bank Account?

While welfare agencies don’t actively seek out secret bank accounts, they may discover them during their investigations. It’s important to be transparent and honest with welfare agencies about your financial situation. Failing to disclose a secret bank account could lead to legal consequences and jeopardize your welfare benefits.

Can Welfare See My Transactions?

Welfare agencies have the ability to view your bank account transactions, especially if they suspect any fraudulent activity. However, they typically focus on monitoring income and financial eligibility rather than scrutinizing individual transactions. Rest assured that your everyday purchases and routine transactions are generally not of interest to welfare agencies.

Should I Hide Money From Welfare Agencies?

Hiding money from welfare agencies can result in serious legal consequences, including criminal charges and loss of benefits. It is always best to be transparent about your finances and work within the guidelines of the welfare program. If you have concerns or questions, it’s advisable to consult with a legal professional specializing in welfare regulations.

Conclusion

To sum up, the question of whether welfare can find out about bank accounts has been thoroughly examined in this blog post. We have explored the intricate processes and legal avenues involved in such investigations. While welfare departments possess certain powers to access financial information, it is important for individuals to understand their rights and take necessary precautions.

By being mindful of these factors, individuals can navigate through these concerns and ensure their benefits remain protected.