Car Insurance Coverage Vediceu: Safeguard Your Journey!

Car insurance coverage varies based on policy and provider. Understanding your policy details is crucial for adequate protection.

Selecting the right car insurance is essential for financial security in the event of an accident or theft. Your coverage can include liability, collision, comprehensive, personal injury protection, and uninsured motorist protection among others. Each type of coverage handles different scenarios, from paying for damages you’ve caused in an accident (liability coverage) to repairing your own vehicle (collision and comprehensive).

Personal injury protection covers medical expenses for you and your passengers, regardless of who is at fault. Additionally, uninsured motorist coverage protects you if the other driver lacks adequate insurance. Always compare policies and read the fine print to ensure your specific needs are met, keeping in mind state requirements and your personal risk factors. A clear understanding of your car insurance coverage options helps in making an informed decision to safeguard your vehicle and financial well-being.

Car Insurance Coverage Vediceu: Safeguard Your Journey!

Car Insurance Coverage Vediceu is essential for protecting your finances in the event of an accident. By understanding the basics of car insurance, you place yourself in a better position to select a policy that fits your needs.

The key components of a typical policy include liability coverage, which covers costs associated with damage or injury to others if you’re at fault in an accident. Others are collision and comprehensive coverage, which provide protection for your vehicle against various types of damage, and personal injury protection, which helps with medical expenses regardless of fault.

Special considerations must be made for different vehicle types. For instance, a luxury car might require additional coverage due to its high cost of repair, while an off-road vehicle might benefit from specialized coverage that takes into account potential damages from rugged terrain.

Navigating Policy Options

Evaluating coverage levels for your needs is essential to ensure you have sufficient protection without overpaying. Begin by assessing the value of your assets and consider a coverage amount that shields these assets in the event of a lawsuit following an accident. It’s recommended to opt for a higher liability limit if you have significant assets.

The importance of liability insurance cannot be overstressed as it covers bodily injuries and property damage to others when you’re at fault. State minimums might not provide enough protection, which could put your personal assets at risk in a lawsuit. Therefore, it’s wise to purchase more than the state-required minimum to safeguard your finances.

Making the right choice between comprehensive and collision insurance depends on several factors such as your car’s age, value, and how you use it. While comprehensive coverage protects against events like theft, vandalism, and natural disasters, collision coverage pays for damages resulting from an accident with another vehicle or object. Consider the current value of your car and whether the cost of coverage is justified.

Customizing Your Car Insurance Plan

Customizing your Car Insurance Plan often involves considering various add-ons and endorsements to tailor a policy that best fits individual needs. Roadside assistance coverage is an invaluable service for motorists who seek peace of mind, providing help in the event of vehicle breakdowns or emergencies. Deciding on the right time to opt for this coverage depends on factors such as the age of the car, frequency of travel, and personal comfort levels with potential road mishaps.

For those who travel regularly or plan vacations, rental reimbursement can mitigate the inconvenience of car repairs. This option covers the cost of a rental car, ensuring stress-free travel while your vehicle is in the shop. By thoughtfully selecting these additional features, policyholders can enhance their car insurance coverage, safeguarding against a wide range of incidents and reducing anxiety on the road.

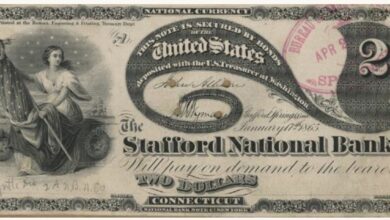

Credit: www.amazon.co.uk

Cost-saving Strategies For Drivers

Securing car insurance can be financially demanding, but savvy shoppers can tap into discounts and deals to trim their premiums. A clean driving record is often rewarded by insurers with lower rates. Demonstrating safe driving habits over time can significantly reduce the cost of coverage. Vehicles equipped with advanced safety features, such as automatic emergency braking or blind-spot monitoring, may qualify for additional discounts. Insurers typically view these technologies as risk-reducers, which can translate to monetary savings for the driver.

Many insurance companies provide a range of discounts, including but not limited to multi-car discounts, loyalty discounts, and good student discounts. Exploring these options may reveal potential savings that might have otherwise been overlooked. Engaging in defensive driving courses is another avenue to not only enhance one’s driving skills but also to achieve premium reductions. It is advisable to regularly review one’s policy and discuss available discounts with the insurance provider.

Handling Claims And Accidents

Filing a claim after a car accident can seem daunting, but knowing the proper steps helps streamline the process. Immediately after the incident, ensure safety and document the scene with photos. Notify your insurer as soon as possible to set the claims process in motion. It’s critical to provide accurate information and any pertinent documentation or evidence you’ve collected.

Communicating with insurers requires patience and organization. Keep detailed records of all conversations and be ready to submit any additional information they may request. It’s often a back-and-forth negotiation, so understanding your policy details is key to ensuring adequate coverage.

The deductible is the amount you pay out-of-pocket before your insurer covers the remaining costs. A higher deductible can mean lower premiums, but it’s important to choose an amount you’re financially comfortable with in the event of a claim.

Frequently Asked Questions For Car Insurance Coverage Vediceu

Is It Better To Have A $500 Deductible Or $1000?

Choosing between a $500 or $1000 deductible depends on your financial comfort. A $500 deductible leads to higher premiums but reduces out-of-pocket costs during a claim. Opting for a $1000 deductible usually offers lower premiums while increasing your initial expense during a claim.

Will My Insurance Go Up If I Hit A Deer Progressive?

Hitting a deer with your vehicle may result in an insurance rate increase with Progressive, depending on your policy details and claim history.

Which Insurance Company Is Best For Car?

The best insurance company for car coverage varies per individual needs. Consider customer service, coverage options, pricing, and discounts. Companies like State Farm, Geico, and Allstate often receive high ratings. Conduct personalized research to find the optimal choice for your situation.

Why Is Progressive So Cheap?

Progressive offers affordable rates by customizing policies to match clients’ needs and employing advanced technology for efficiency. Their competitive pricing also stems from a range of discounts and a well-managed, large customer base to distribute risk.

Conclusion

Understanding car insurance coverage is key to safeguarding your journey on the road. With the right policy, you’re not just investing in protection against unforeseen incidents – you’re also ensuring peace of mind. Selecting the best coverage takes careful consideration, but it’s an invaluable step for any vehicle owner.

Drive confidently, knowing you’ve made a well-informed choice.