Best Credit Card for Insurance: Maximize Your Benefits!

The Chase Sapphire Reserve is widely considered the best credit card for insurance benefits. It offers extensive travel and purchase protections, appealing to frequent travelers.

Credit cards have become multifaceted financial tools, often bundled with benefits that include insurance coverage. The Chase Sapphire Reserve stands out in the credit card market for its comprehensive insurance offerings, which cater to various potential needs of cardholders. With features like trip cancellation/interruption insurance, primary auto rental collision damage waivers, and even emergency medical and evacuation coverage, this card provides a safety net for travelers.

Alongside travel protection, purchase benefits like extended warranty and return protection add layers of security to shopping experiences. Evaluating credit cards based on insurance perks requires a closer look at the fine print, as coverage limits and conditions can significantly influence the card’s value. Therefore, it’s crucial to understand the depth and breadth of insurance provided by any card before making a choice. The Chase Sapphire Reserve continues to be a top contender in the balance of rewards and protective features.

Key Features To Consider

Choosing the best credit card for insurance necessitates evaluating the variety of reward programs and cash back options available. Cards that offer a generous cash back percentage for insurance payments can significantly reduce overall expenses. It is essential to scrutinize the Insurance Coverage Types provided, as they can vary from travel accidents to rental car damage waivers. Moreover, understanding the balance between premiums and deductibles is crucial. A comprehensive deductibles analysis ensures you are not caught off-guard by unexpected expenses should you need to make a claim.

When evaluating card options, Cards Acceptance Worldwide is a pivotal feature. A card that is widely accepted can alleviate the stress of finding compatible ATMs or merchants overseas, ensuring a seamless experience. Opting for a credit card that consistently delivers high global acceptance will serve as a reliable financial tool during international travels.

Holistic Insurance Benefit Breakdown

The Travel Insurance Advantages of the best credit cards offer peace of mind for adventurers. Benefits include coverage for trip cancellations, emergency medical expenses, and lost luggage, ensuring your trips are guarded against unforeseen events. Opting for a card with comprehensive travel insurance maximizes security and minimizes hassle during your travels.

Purchase Protection Insights reveal that select credit cards act as a safeguard for new purchases. Protection against theft or damage over a specified time frame, typically within 90 days from purchase, can be a financial lifesaver. Seeking out cards offering this benefit can secure your investments on everything from electronics to luxury goods.

Understanding the Auto Rental Collision Damage Waiver is crucial for those who frequently rent cars. This waiver often replaces the need for rental company insurance by providing coverage for collision damage or theft of the rented vehicle. A credit card with a solid auto rental waiver can lead to significant savings and less worry on your road journeys.

Exclusive And Hidden Features Unveiled

Discovering the right credit card for insurance can significantly enhance your purchasing power and peace of mind. One of the most compelling features is the Extended Warranty Extension benefit. This often overlooked perk extends manufacturer warranties, often doubling the original coverage period, ensuring long-term protection for your purchases.

Emergency Assistance Services are another hidden gem among credit card benefits. These services offer invaluable help during unexpected situations, such as medical referrals, legal assistance, and urgent message relay, protecting cardholders wherever they go. Choosing a card that includes these features can transform your insurance needs, providing both practicality and security.

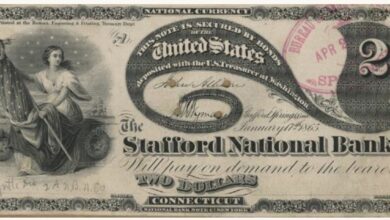

Credit: www.nerdwallet.com

Utilize All Available Insurance Options

Understanding your policy’s fine print is crucial to maximizing the benefits of your credit card insurance. Ensure to comprehend the terms and exclusions, as these can significantly affect your coverage. Insurance policies can vary widely, and knowing what is covered can help you avoid unforeseen expenses in the event of an emergency.

Keeping track of coverage limits is equally important. Credit cards often come with built-in insurance benefits, such as travel insurance, car rental damage waivers, or purchase protection. However, these benefits are not limitless and usually come with caps. Understanding these caps allows you to assess the adequacy of your coverage and decide if additional insurance is necessary. Regularly reviewing your insurance coverage ensures that you are always prepared for the unexpected.

Smart Spending For Greater Coverage

Choosing the best credit card for insurance purposes can significantly enrich your fiscal toolkit. Smart individuals often highlight the value of having a credit card that offers robust insurance benefits, especially for those who travel frequently. By strategically allocating expenses to these cards, users can maximize potential coverages such as travel accident insurance, rental car insurance, and even lost luggage reimbursement.

Particular attention should be given to leveraging the intrinsic travel-related perks of credit cards. One might opt for a card that extends comprehensive travel insurance as a benefit, effectively safeguarding against unforeseen circumstances while abroad. Ensuring you select a card that aligns with your travel habits and insurance needs could mean the difference between a trip ruined by incidentals and one that is secured with suitable coverage.

Real-life Examples Of Insurance Payoffs

Travel Mishaps and Credit Card Rescues often underscore the value of having the right credit card for insurance. Frequent travelers share tales of unexpected trip cancellations where credit card insurance benefits saved them thousands. Imagine facing a medical emergency overseas; with the proper card, individuals had their expenses covered and assistance organized swiftly. These stories not only highlight financial savings but also the priceless peace of mind provided during stressful times.

Theft and Loss Protection Stories are testament to the hidden worth of credit cards with robust insurance features. Users recount scenarios where stolen phones and lost luggage could have been major setbacks. Instead, their credit card’s theft and loss protections offered reimbursements, mitigating what could have been a costly event. Such real-life examples illustrate why choosing the best credit card for insurance is a strategic financial decision.

Customer Testimonials And Experiences

Customers consistently praise the flexibility and security that comes with choosing the best credit cards for insurance. Many users report significant savings on travel and medical expenses, highlighting the ease of filing claims and receiving prompt reimbursements. Stories often include anecdotes of effortless resolution of fraudulent charges and quick replacement of lost or stolen cards, thanks to the robust protection offerings.

Reliable credit card insurance proves essential for overcoming various obstacles faced by cardholders. Individuals recount instances where their credit card insurance was a lifesaver during emergency medical situations abroad and for unexpected trip cancellations. The provided coverage effectively addressed complications stemming from lost luggage and delayed flights, further demonstrating the inherent value of their chosen credit card’s insurance features.

Regular Review And Comparison

Regular review and comparison of credit cards are essential to ensure you have the best credit card for your insurance needs.

To stay informed about new credit card offerings, it’s vital to actively monitor market trends and updates. Financial institutions frequently introduce new products with competitive benefits that may align more closely with your insurance coverage requirements.

Assessing your changing insurance needs is a continuous process. Changes in lifestyle, financial status, or family dynamics can alter the type and amount of insurance you need. By reassessing your needs regularly, you can identify if your current credit card still offers the most valuable perks and insurance benefits, or if it’s time to switch to a card that better suits your new circumstances.

Building A Strong Relationship With Your Card Issuer

Forging a strong relationship with your credit card issuer can lead to exclusive insurance benefits and service enhancements. Understanding the channels through which to communicate effectively with customer service teams can result in personalized account management and even potentially waiver of certain fees. It’s all about consistency in your approach and ensuring your concerns and queries are addressed with due diligence.

Engaging with available loyalty programs may also unlock a tier of elite upgrades that can augment your insurance coverage – from extended warranties to higher claims on travel insurance. Utilizing the credit card’s customer service to its full extent, may reveal hidden perks that come with your level of loyalty, fostering a mutually beneficial relationship between you and the card issuer.

| Customer Service Benefits | Loyalty Program Perks |

|---|---|

| Personal account advisor | Complimentary upgrades |

| Fee waiving negotiations | Greater insurance claims |

| Early access to new offers | Exclusive bonus points |

Frequently Asked Questions On Best Credit Card For Insurance

Which Credit Card Is Best For Paying Insurance Premium?

The best credit card for paying insurance premiums offers rewards, low fees, and cashback options. Cards like the Chase Sapphire Preferred or Citi Double Cash often provide such benefits. Always compare current offers for optimal savings.

Should I Use Credit Card For Insurance?

Using a credit card for insurance payments can offer convenience and rewards but consider interest rates and potential debt. Assess your ability to pay off the balance monthly to avoid extra charges.

Do I Get Car Insurance With My Credit Card?

Many credit cards offer rental car insurance as a perk. Check your card’s terms or contact your issuer to confirm coverage specifics.

Does Credit Card Have Insurance Coverage?

Some credit cards offer insurance benefits, such as rental car coverage, travel insurance, and purchase protection. Check your card’s policy for details.

Conclusion

Wrapping up our exploration of the top credit card options for insurance benefits, it’s clear the right choice varies per individual needs. We’ve highlighted key features that offer peace of mind and financial security. Remember to consider your lifestyle and insurance requirements when selecting.

Forge ahead, secure in your transactions with the ideal credit card in your wallet.