Life Insurance Return of Premium: Maximize Your Benefits!

Life insurance with a return of premium feature refunds the total amount of premiums paid if the policyholder outlives the policy term. This type of policy offers both coverage and a savings incentive.

Life insurance is essential for those who want to ensure their family’s financial stability in the event of unforeseen circumstances. With a return of premium life insurance policy, you get the traditional benefits of life insurance, such as beneficiary protection, coupled with a financial safety net if coverage turns out to be unneeded.

It’s a unique product bridging the gap between long-term security and investment value, serving as an appealing choice for individuals seeking the security of life insurance without feeling the pinch of lost premiums. While these policies might come at a higher cost compared to term life insurance, the promise of a premium refund can be an enticing option for the right buyer.

Credit: www.bylinebank.com

What Is Return Of Premium?

Life insurance is a contract between an insurer and a policyholder, where the insurer guarantees payment to named beneficiaries upon the death of the insured. Return of Premium (ROP) life insurance is a type of policy that refunds the premiums paid by the policyholder if they outlive the term of the policy. It merges the benefits of traditional term life insurance with a savings aspect.

Under ROP, policyholders pay a fixed rate for a set period. If the insured survives the policy term, the insurance company refunds the amount of the premiums. These policies cost more than standard term life insurance due to the refund component.

Comparing R.O.P. policies to traditional term life insurance, the key differences include:

- The premium return feature in ROP upon term completion.

- Higher premiums for ROP due to the refund of premiums benefit.

- Potential lack of interest accrual on the returned premiums.

ROP may suit individuals seeking both life insurance coverage and a form of forced savings, while standard term policies could be more beneficial for those focusing merely on the death benefit.

Benefits Of Return Of Premium

Return of Premium (ROP) life insurance offers a unique advantage for policyholders, as it blends the protective aspects of traditional life insurance with a financial safety net. A distinct feature is the possibility of getting all the premiums back if you outlive the policy term, essentially allowing you to enjoy coverage without the cost. This aspect of ROP serves as a forced savings plan, where the money you put in can be retrieved in full, minus any fees or loans against the policy.

Choosing ROP means you are not just securing your loved ones against financial distress, but also building a reserve for your future. These plans are particularly appealing as they combine peace of mind with the practicality of getting your investment back should you not require the death benefit. This benefit typically turns an expense into a pseudo investment, making it a prudent choice for those who prioritize financial planning.

Evaluating Premium Costs Vs. Returns

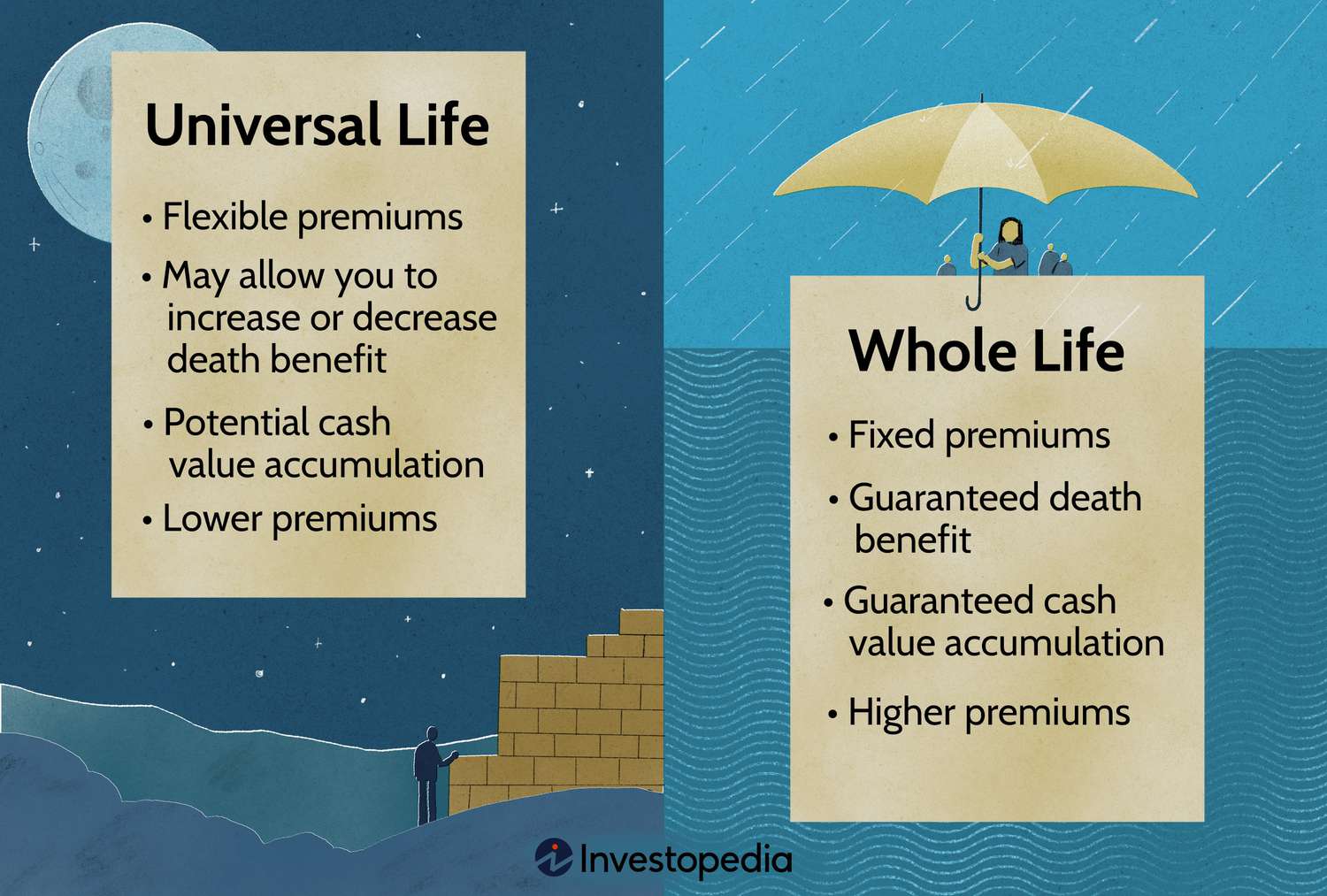

Evaluating the costs and benefits of traditional life insurance compared to Return of Premium (ROP) life insurance reveals the long-term financial implications. An ROP policy often carries higher premiums, but promises to refund the total amount paid if the policyholder outlives the term. In contrast, traditional life insurance has lower premiums, but there is no return if the policy is not triggered.

| Parameter | Traditional Life Insurance | ROP Life Insurance |

|---|---|---|

| Premiums | Lower | Higher |

| Potential Return | None, unless claimed | Total premiums returned |

| Investment Opportunity | Potential to invest savings from lower premiums | Lesser due to higher premiums |

Policyholders must weigh the opportunity cost of higher premiums against the security of a potential refund. Selecting the right insurance plan necessitates a thorough analysis of individual financial strategy and the ability to forbear higher upfront costs for a future payoff.

Smart Strategies To Maximize Return Benefits

Purchasing life insurance early in life is a strategic move to help maximize the benefits of a Return of Premium (ROP) policy. The younger you are, the lower the premiums generally are, which translates into greater savings over the life of the policy. Timely acquisition is not only cost-effective but also provides a longer accumulation period, increasing the total amount returned at the end of the term. It’s essential to understand that ROP policies tend to be more beneficial the longer they are held.

Using ROP as an investment tool can be a savvy financial strategy. By choosing a policy with a return of premium feature, policyholders often equate the premiums paid into a long-term, interest-free savings account. Upon maturity, the total sum of premiums is returned, which can then be reinvested into higher-yield opportunities, serving as a financial springboard for future investments.

Common Misconceptions About Rop

Many people hold the incorrect belief that Life Insurance with Return of Premium (ROP) is excessively costly and doesn’t provide a sound financial investment. Contrary to this, ensuring realistic expectations from your policy means understanding that while premiums may be higher compared to term life insurance, the ROP feature offers reimbursement of premiums at the end of the term if no claim is made. It’s crucial to grasp that these policies are not designed to act as traditional investments, and their benefits should be considered in the context of life insurance coverage first and foremost.

A common misconception is that ROP policies automatically generate wealth. Instead, the return of premium is essentially acquiring life insurance coverage at no net cost over the long term, assuming the policyholder outlives the term of the policy. Individuals should align their expectations with the idea that the return is essentially a refund of the premium payments and not a profit-generating investment. With attuned expectations, policyholders can make informed decisions regarding their life insurance needs while understanding the unique value proposition an ROP policy provides.

Frequently Asked Questions Of Life Insurance Return Of Premium

What Is The Return Of Premium In Life Insurance?

Return of premium in life insurance guarantees refunding of all premiums paid if the policyholder outlives the policy term.

Is Return Of Premium Life Insurance Worth It?

Return of premium life insurance can be worth it for individuals seeking both coverage and a guaranteed refund if they outlive the policy. However, it’s generally more expensive than term life insurance, so weighing the cost against the potential benefits is crucial.

Do You Get Premiums Back On Life Insurance?

Typically, you do not receive premiums back on term life insurance. With a return of premium life insurance policy, you can get premiums back if you outlive the policy term.

Is Return Of Premium On Life Insurance Policy Taxable?

Return of premium from a life insurance policy is generally not taxable. These refunds are considered a return of your paid premiums, not income.

Conclusion

Navigating life insurance options can be daunting, yet understanding Return of Premium (ROP) policies simplifies the choice. ROP offers the dual benefit of protection and refunded premiums if the coverage isn’t used. This makes it an appealing route for those seeking both security and financial prudence.

No investment is foolproof, but a Return of Premium life insurance plan stands out for merging coverage with a potential money-back guarantee. Consider your needs and consult a professional to see if it suits your insurance strategy.