Car Accident Insurance Claim Akib.In: Get Max Payout Fast!

A car accident insurance claim Akib is a demand for payment to an insurance company following a car accident. Initiate the process by notifying your insurer immediately after the accident.

Navigating a car accident insurance claim can often seem daunting, but prompt and precise action is crucial to ensure a smooth process. Understanding the essentials of filing a claim helps secure the compensation you deserve. Begin by reporting the accident to your insurance provider, collecting necessary information such as the other party’s details, and documenting the scene with photos.

Keep communication lines open with your insurer and consider consulting a professional when needed. Stay organized with your documentation and evidence; it strengthens your claim and helps expedite the settlement process. Remember, maintaining a clear record and engaging with your insurance company efficiently is foundational to a successful claim.

Understand Your Policy Coverage

Understanding your car accident insurance claim begins with a thorough review of your policy. It’s essential to know your policy’s limitations, as these can significantly affect the claim process. Each policy has a maximum coverage limit that sets the cap on how much the insurer will pay.

Digging into the policy details reveals the specific perils and incidents that are covered and, just as importantly, those that are excluded. Reflect on scenarios such as theft, natural disasters, or vandalism, ensuring they align with your insurance protection expectations. Distinct from policy limitations are deductible fees, which dictate the out-of-pocket costs required before insurance contributions kick in. This cost-sharing aspect influences the overall financial impact of a claim.

| Aspect | Details to Consider |

|---|---|

| Policy Limitations | Check the maximum payout and how it aligns with your vehicle’s value and potential repair costs. |

| Covered Perils/Exclusions | Review listed events; ensure understanding of protection scope and uncovered risks. |

| Deductibles | Know your deductible amounts to estimate the personal financial responsibility in an event of a claim. |

Documenting The Accident Scene

Documenting the accident scene thoroughly is crucial for a successful car accident insurance claim. Ensure to collect adequate evidence which includes taking plenty of photos from different angles to establish the extent of the damage and the layout of the scene. Detailed photographs serve as irrefutable evidence, playing a vital role in the claims process.

Photographic documentation should not be limited to the vehicles and injuries but also include traffic signs, road conditions, and any obstacles that might have contributed to the accident. This visual data can provide a clearer picture of the incident for insurance adjusters, police, and if necessary, legal counsel.

Gathering necessary information from the other involved parties is a step you cannot overlook. Exchange contact information, insurance details, and the vehicle’s registration number. Having accurate and immediate information about the involved parties can expedite the claim process significantly.

Immediate Steps After An Accident

After experiencing a car accident, securing safety is paramount. Quickly assess the situation to ensure no immediate dangers persist. Establish the safety for yourself, passengers, and others involved by moving to a secure location, if possible. Report the incident to local authorities by calling emergency services. This ensures that official documentation of the incident is recorded, which is critical for the insurance claim process.

Initiating the insurance claim starts with prompt notification to your insurer. Providing a preliminary account of the accident activates the claim process. It’s essential to contact your insurance company as quickly as after the accident, as most policies mandate reporting within a specific timeframe.

- Document all expenses related to the car accident, including towing fees, medical bills, and missed work wages.

- Compile a comprehensive list of car repairs and any replacement costs for personal items damaged during the incident.

- Retain all receipts and bills, as they will serve as crucial evidence when substantiating your claim with the insurance company.

Crafting A Compelling Claim

A clear and concise description of the car accident is critical for a successful insurance claim. Document time, date, location, and conditions under which the incident occurred. Include any relevant details such as traffic signals, road signs, and the behavior of involved parties.

Well-organized documentation can expedite the claim process. Ensure you have all necessary paperwork including a police report, witness statements, and photos of the scene. Maintain a dedicated folder for receipts of any expenses incurred, such as towing services or medical bills.

Articulate your losses and damages with precision. Include estimates or bills for vehicle repairs, medical treatments, and any income lost due to the accident. This demonstrates the financial impact of the incident and supports your claim for appropriate compensation.

Settlement Negotiation Tactics

Settlement negotiation tactics are key for successfully navigating the car accident insurance claim process. Understanding how to effectively communicate with insurance adjusters and counter lowball offers can significantly impact the outcome of your claim. It’s essential to be well-prepared and informed before entering negotiations.

During discussions, articulate the details of the accident and the resulting damages with clarity. Ensure that all communication with adjusters is professional and backed up by evidence. Documentation such as medical records, repair estimates, and proof of income loss will strengthen your position.

Utilize facts and figures to support your compensation demands and be prepared to explain the rationale behind your valuation. If faced with a lowball offer, respond with a well-reasoned counteroffer. This should be based on accurate calculations of your damages, not emotions.

| Strategies | Description |

|---|---|

| Professional Communication | Always maintain a factual and respectful tone in discussions. |

| Documentation | Gather all relevant records to substantiate your claim. |

| Counteroffers | Don’t accept the first offer; counter with logical reasons for a higher amount. |

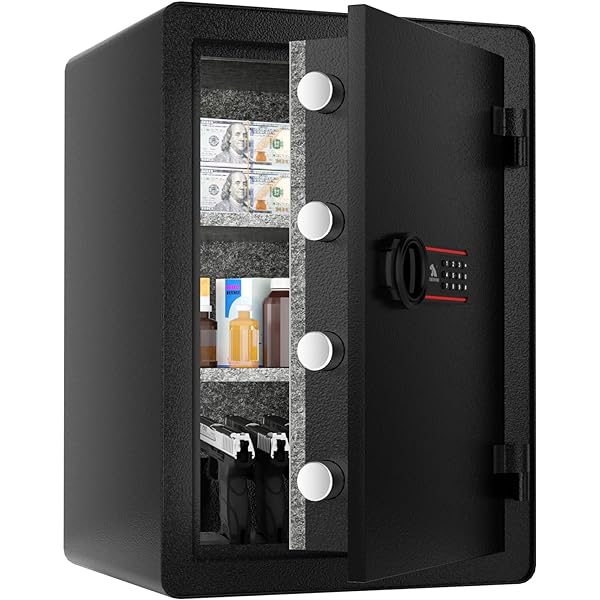

Credit: www.amazon.co.jp

Maximizing Claim Payout Potential

Maximizing Claim Payout Potential necessitates a strategic approach post-car accident. Utilizing Professional Appraisals can significantly bolster the legitimacy of your claim. Certified appraisers provide accurate vehicle damage valuations, assisting in countering low offers from insurance companies.

Leveraging Third-party Reports serves as an objective basis for your claim. Comprehensive documentation from authoritative sources, such as independent mechanics or accident reconstruction experts, underscores the severity and impact of the incident, compelling insurers to offer fair compensation.

Instances arise where insurance companies are unyielding. Seeking Legal Advice When Necessary becomes imperative. Experienced attorneys negotiate assertively, navigating the intricacies of insurance law to safeguard your rightful compensation. Their involvement often prompts insurers to propose more reasonable settlements, acknowledging the potential for litigation.

Frequently Asked Questions On Car Accident Insurance Claim Akib.in

What Are The Steps The Insurance Claims Process?

Report the incident to your insurance company immediately. Provide necessary details and complete claim forms. The insurer will review the claim and may investigate. Upon claim approval, you will receive a payout. Ensure to submit any additional documents requested promptly.

Why Do Insurance Companies Take So Long To Pay Out?

Insurance companies may take time to pay out claims due to extensive claim validation processes, required documentation reviews, and sometimes, internal bureaucracy or claim disputes, which can prolong the settlement timeframe.

How Do Insurance Companies Pay Out Claims?

Insurance companies typically assess the claim, verify policy details, and determine the payout amount. After approval, they issue payment directly to the policyholder or relevant party, usually through check or bank transfer.

What To Do Immediately After A Car Accident?

Immediately after a car accident, ensure everyone’s safety, and call 911 if there are injuries. Exchange contact and insurance info with the other parties involved. Take photos of the accident scene and vehicles. Report the accident to your insurance company as soon as possible.

Conclusion

Navigating car accident insurance claims can be tricky, but with proper guidance, it’s manageable. Remember to document everything, know your policy, and don’t rush the process. Seeking expert advice can be invaluable. Stay informed and advocate for your rights to ensure a fair outcome in your insurance claim negotiation.

Stay safe on the roads and confident in your approach to any potential accidents.